Bracing for the Forecasted Storm: The Mortgage Scenario Ahead If you're anything like me, you've been keeping a watchful eye on financial forecasts lately, and a certain sense of trepidation has crept in. A recent article in The Times has set the alarm bells ringing, predicting a surge in interest rates that could potentially add a whopping £3,000 burden to annual mortgage costs. For all you property...

Market News

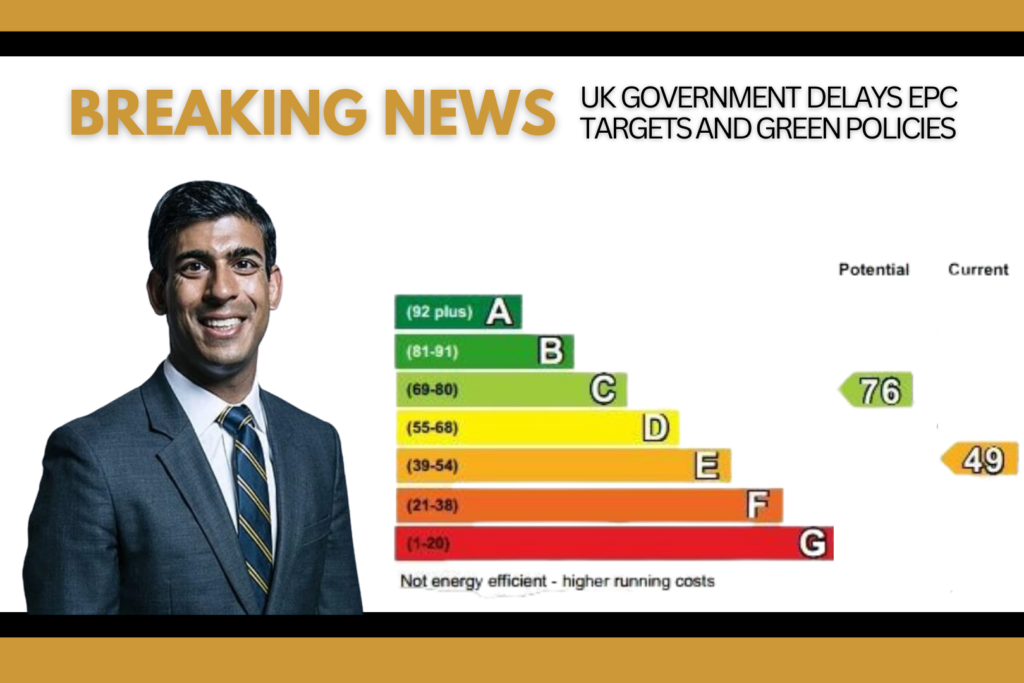

In a recent announcement, Prime Minister Rishi Sunak's decision to remove Energy Performance Certificate (EPC) targets and delay various green policies has stirred a range of emotions within the property industry. While some see it as a temporary relief, others express frustration and concerns about the implications of these changes. Let's delve into the details of this breaking news and the reactions it...

If you've been keeping a close eye on the UK property market, you'll know that it's been nothing short of a rollercoaster ride lately. As your property aficionado, I've spent a considerable chunk of my morning delving into insightful articles from esteemed sources such as the BBC, Financial Times, and 'This is Money,' to provide you with a concise overview of the current state of affairs. BBC's...

Investing in property is a time-tested avenue for building wealth and securing financial futures. As the UK property market continues to be an attractive prospect for investors, understanding the basics of property investment is essential for those looking to dip their toes into this lucrative arena. In this beginner's guide, we'll walk you through the fundamentals of property investment in the UK,...

Dive into the Latest Changes and Stay a Step Ahead In the fast-paced world of property management, staying informed and adapting to regulatory changes is crucial. Recently, I stumbled upon an insightful blog post that delves deep into the latest developments surrounding the Housing Health and Safety Rating System (HHSRS). As responsible landlords, it's essential for us to have a comprehensive...

It’s that time again – interest rates are on the move. We know you're the bold ones, the ones who have weathered various storms in the property market. So, let's roll up our sleeves and dive into what these changes might mean for us. For Us, the Bold Landlords: Adapting and Strategizing The recent interest rate rise might have caught your attention, and there's no use sugar-coating it – this...

Read books and articles: There are many books and articles available on property investment, both online and in print. Start with introductory texts and work your way up to more advanced material as you gain experience. Attend seminars and workshops: Consider attending property investment seminars and workshops in your area. These can be an excellent way to learn about the latest investment...

It's difficult to determine the "best" coaches or mentors, as the definition of "good" can vary greatly depending on an individual's specific needs and goals. However, here are some factors to consider when looking for a coach or mentor: Experience: Look for a coach or mentor who has extensive experience in the UK property market and a track record of success. This can provide you with valuable...

BRRR, is an investment strategy that involves buying a property, refurbishing it, renting it out, and then refinancing the property to extract equity. The extracted equity can then be used to purchase additional properties, creating a cycle of investing in properties. Pros: Potential for significant profits: BRRR can be a lucrative investment strategy, as investors can extract equity from refinanced...

Managing a House in Multiple Occupation (HMO) can be a good investment strategy for some investors. HMOs are properties that are rented out to multiple tenants who share common living spaces, such as kitchens and bathrooms.Pros:Higher rental income: HMOs typically generate higher rental income than single-family homes, as multiple tenants are sharing the same property.Strong demand: There is often strong...